Housing Affordability

Please choose any of the following articles below that interest you. Each article is listed under the month it was written. Articles written in prior months may still have educational interest.

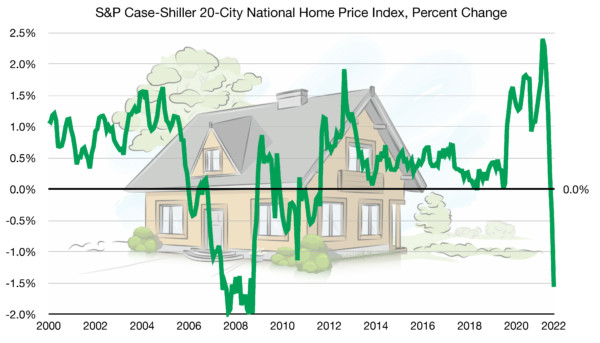

Series 2 of 2: Home Prices Fall for the First Time in 10 Years

Ever since the housing market plummeted in the 2008 Great Recession, houses have skyrocketed in price. Even with home prices falling, houses are at relatively low affordability levels which a fall in prices which may change in the near future.

The average home price in the U.S. is currently over $525,000, an increase of over $325,000 since 2000 and over $265,000 more expensive than in 2009. In a state like California, where housing prices are much higher, the average home price is around $925,000, a $665,000 increase since 2000.

According to new research, it takes over 8 years of income to currently purchase a home, up from an average of 5 years of income over the past 54 years. However, real wages are declining, and the median U.S. personal income is $44,225. For someone making this income, the average U.S. home is worth almost 12 years of work.

Recent data from an index that tracks home prices across 20 major cities has just shown its first contraction in over a decade- since March of 2012. This means that home prices have fallen, ending a decade-long surge by falling to -0.44% from June to July of 2022. This decline is also the largest fall in the history of the index, falling over 2.8% since the February high. Prices are still the highest they have ever been, but rising mortgage rates have begun to weigh on housing prices which may lead to a cooler or even contracting market. This discourages large loans to be taken out to purchase homes, yet encourages homebuyers who can pay a majority of the home price up-front.

Sources: U.S Census Bureau, U.S. Federal Housing Finance Agency, S&P Dow Jones Indices, Rosenberg Research, World Population Review, Federal Reserve Bank of St. Louis

Print Version: Housing Affordability Series Nov 2022