Home Sales Fall Across the Nation – Housing Update

Please choose any of the following articles below that interest you. Each article is listed under the month it was written. Articles written in prior months may still have educational interest.

Following seven consecutive quarters of double-digit increases in the median sales price of American homes, pending home sales have reached an all-time low as fewer homeowners are looking to sell their homes. The reasoning behind most homeowners’ thinking is that, with home prices at historic highs, they will have nowhere to comfortably move to after selling their residences.

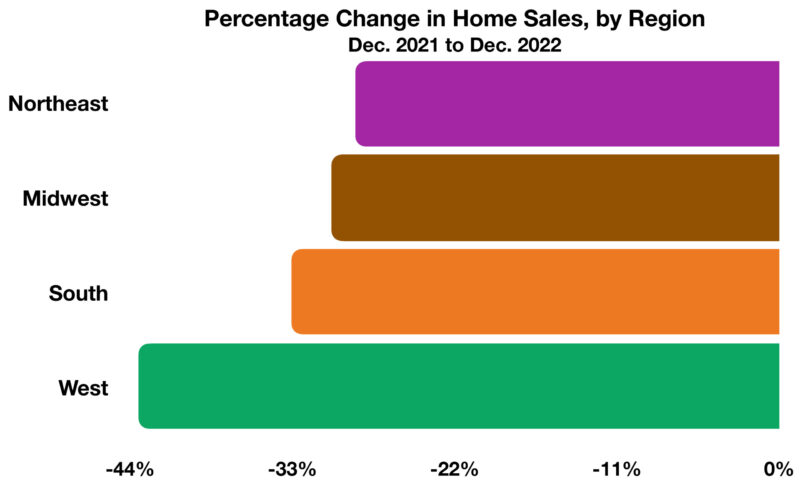

In the third quarter of 2022, the median American home price across the nation eclipsed $450,000 for the first time recorded and upheld an ongoing period of double-digit home price increases. This is the second-longest period of double-digit increases ever recorded, only behind a period between Q4 1977 to Q3 1979. With home prices at such abnormal highs, fewer potential purchasers are willing to meet extreme costs and fewer existing homeowners are willing to move on from their residences and purchase a different one in such an unstable market. This can be exhibited across the nation, with the housing affordability index down 36% and existing home sales nationwide down 35%. The housing crisis has affected western states abnormally harsher than the rest of the country, with higher home prices and home sales down nearly 46% in the region.

Overall, a stagnated housing market has persisted since 2021 and may worsen if home prices continue to climb from already overpriced levels. While mortgage rates have also maintained abnormally high levels, they have decreased slightly from their previous peaks which sends an optimistic sign for potential home buyers. However, low inventory across the nation and falling home sales can signal continued stagnation in the housing market.

Sources: National Association of Realtors, U.S. Census Bureau, Freddie Mac, S&P Dow Jones Indices, Federal Reserve Bank of St. Louis.

Print Version: Feb 2023 Home Sales Fall Across the Nation Housing Update