Consumers Are Saving Less – Consumer Behavior

Please choose any of the following articles below that interest you. Each article is listed under the month it was written. Articles written in prior months may still have educational interest.

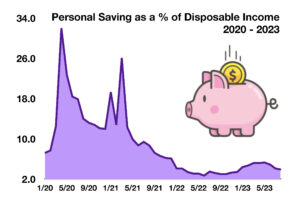

According to the Bureau of Economic Analysis, data has revealed that Americans are saving less than initially thought. From 2017 through 2022, American consumers were thought to have saved an average of 9.4% of their disposable income. However, revised data figures have identified that the actual savings rate was 8.3%. Various possible explanations as to why such a drop may have occurred include higher fuel prices, recently implemented student loan repayments, lower real wages, and exhaustion of pandemic relief funds.

Economists view decreased savings as a signal that consumers may be shifting expenditure patterns thus altering where their funds are being spent. Inflationary pressures over the past two years have already redirected some consumer funds from non-essential goods and services to more essential items such as food and gasoline.

Spending habits adjusted during the pandemic, as government stimulus funds padded consumer savings for millions. The National Bureau of Economic Research found that roughly 30% of stimulus checks went to consumer savings, while another 30% went to pay off debt.

Personal savings reached a historical high in the midst of the pandemic, as retail stores and restaurants were shuttered and stimulus checks went unspent. The savings rate reached 32% of disposable income in April 2020, yet has fallen to 3.9% as of this past August.

Sources: National Bureau of Economic Research, BEA

Print Version: Consumers Saving Less Oct 2023

PlanRock offers investment due diligence services for Investment professionals. PlanRock offers Exchange Traded Funds on the New York Stock Exchange. See prospectus for more details. Please contact 800-677-6025 or go to www.PlanRock.com for more information about how we can help you reach your goals.

© PlanRock Investments, LLC. The content above is available for use only by authorized subscribers, clients and where permissible as such. This content is not authorized for resale. Past performance does not guarantee future results. The sources we use are believed to be reliable, but their accuracy is not guaranteed.