Higher Mortgage Rates Keep Homebuyers from Buying – Housing Market

Please choose any of the following articles below that interest you. Each article is listed under the month it was written. Articles written in prior months may still have educational interest.

With interest rates breaching higher levels, mortgages are becoming less affordable for millions of Americans. As a result, demand for new mortgages continues to reach decades-long lows, influencing homebuyers to either wait for rates to fall or for home prices to drop significantly.

Economists believe that a unique dynamic has evolved from the current housing environment. Existing homeowners with low mortgage rates are hesitant to sell and move into a higher-rate mortgage, enticing homeowners to stay put. This in effect minimizes the inventory of homes available for sale and possibly acts as a price buffer for available homes.

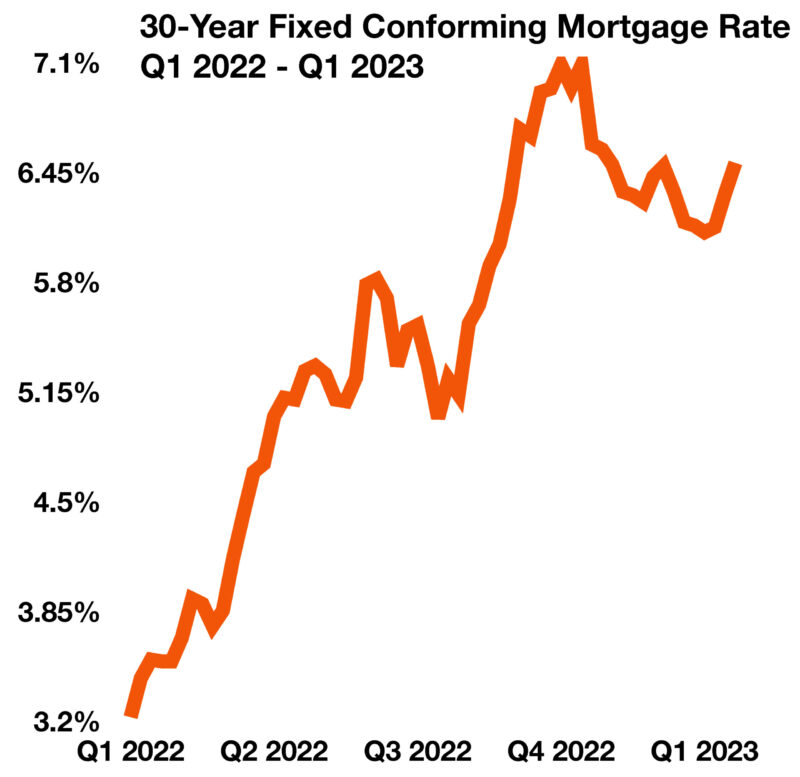

The 30-year fixed mortgage rate reached 6.65% in early March, its highest point since November of last year. This comes amidst continuously higher mortgage loan rates that reached as high as 7.08% in October and November of 2022, a 20-year high that the housing market last saw in 2002.

Sources: Federal Reserve of St. Louis, Freddie Mac.

Print Version: Higher Mortgage Rates Keep Homebuyers from Buying March 2023